If the rules around social functions are followed, employee events like your end-of-year party, or your summer barbecue are tax-deductible for you, as the employer, and tax-free for your staff.

Whether your party is taking place in the office, at a local restaurant or via Zoom for your remote-working teams, you can be confident that you can claim tax relief on the expenditure – The HM Revenue & Customs (HMRC) rules apply equally to any online staff events and remote parties.

Meeting the rules for tax-exempt staff functions

The annual function exemption means that your company can deduct costs for tax when holding an eligible annual staff social event. It also means that your employees don’t pay tax or national insurance contributions (NIC) on costs relating to these social events.

This all sounds like good news, but how does the exemption actually work? And what are the specific rules that you need to know about?

- How do I know if my event is eligible? – for your event to be eligible, it must be company-wide and meet the requirements of a structured social event, i.e. where food, drink and possibly entertainment are provided. Where the business has several locations, an annual event that is open to all staff based at each location is still considered as qualifying, as are separate events organised for different departments, providing all employees can attend one of them.

- What records do I need to keep? – as a company, you’ll need to keep records of who was invited to the social event, and who actually attended. You’ll also need to record the costs of putting on the event, including all associated travel and accommodation.

- What is the expenses limit per person? – there is an annual limit per attendee (including partners invited as guests) of £150 including VAT. This total can be split over multiple functions – e.g. over your Christmas party, plus an Easter party and a summer event. NOTE: this can’t be disguised as client entertaining. Guests must be employees or their partners and not clients or suppliers etc. Although the £150 includes VAT, the VAT in respect of employees (but not invited partners) is deductible in the same way as any other input tax on business expenses.

- What happens if this limit is exceeded? – If the total cost per person is exceeded, the costs are still deductible for the company. However, any amounts not covered by the annual events exemption would be seen as a taxable benefit for the employee (including the amount for their guests), unless the employer reports to HMRC through a PAYE Settlement Agreement (PSA).

- How does this work in practice? – if you hold three annual functions costing £70/£60/£40 per head, your choice may be to apply the exemption to the £70 and £60 functions (total cost of £130 per head). The balance of £20 (from the £150 limit) is lost and the £40 is taxable on the employee and will need to be reported on form P11D. The employer will pay Class 1A NIC on the full cost of the event. Functions covered by the £150 exemption do not have to be reported on form P11Ds. This can be avoided by using a PSA.

- Salary sacrifice – If such events are part of a salary sacrifice arrangement, the exemption does not apply and you will need to report the benefit on annual forms P11D.

The annual exemption is a great benefit for your company and its employees. It is also worth noting that if you are a one-person company, you could equally apply the benefit to taking your spouse out for a social event, but on this occasion, there would be no VAT recovery.

Get in touch with us about claiming expenses for your employee events

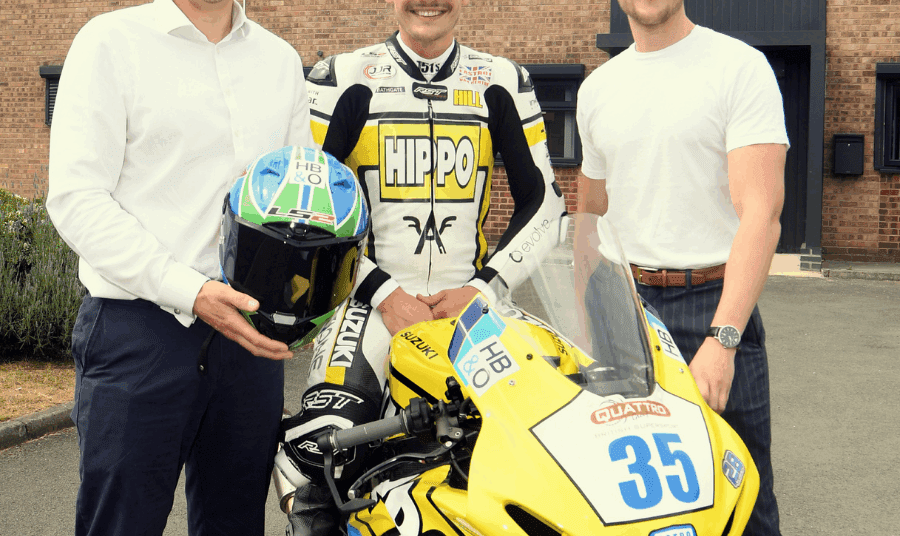

Our specialist tax team at HB&O can help you ascertain whether your team events meet the annual exemption requirements and the best course of action for claiming back the cost. If you would like to find out more about how we can help you, please don’t hesitate to get in touch.

Email: [email protected]

Phone: 02476 306 029