Navigating the complexities of finances can be challenging, especially during times of financial strain. HM Revenue and Customs understands these challenges and offers the Time to Pay arrangement to help businesses manage their VAT payments. This initiative is designed to support those experiencing cashflow difficulties by allowing them to spread their VAT liabilities over a more manageable timeline. Time to Pay arrangements enable businesses to sustain operations and focus on growth by alleviating immediate financial burdens, even in challenging economic climates.

In response to these needs, HMRC introduced an online, self-service Time to Pay option last year, making securing a Time to Pay arrangement a little more accessible. The new service is available via the taxpayer’s Business Tax Account, which can be accessed using this link.

https://www.tax.service.gov.uk/set-up-a-payment-plan/govuk/vat/start.

Understanding the Time to Pay arrangement

- Eligibility criteria

The eligibility criteria were updated at the end of 2023, allowing more business to use this service.

You can set up a VAT payment plan online if you:

- Have missed the deadline to pay a VAT bill

- Owe £50,000 or less

- Have debt for an accounting period that started in 2023 or later

- Plan to pay your debt off within the next 12 months

- Do not have any other payment plans or debts with HMRC

- Have filed all your tax returns

Please note that you cannot set up a VAT payment plan online if you are in the Cash Accounting Scheme, Annual Accounting Scheme or make payments on account.

- Steps to apply for Time to Pay

If, as a taxpayer, you find yourself in the position of being unable to meet your quarterly VAT payment, we would always recommend contacting HMRC immediately. It is essential to consider that you will need evidence to back up why you would be a good candidate for the Time to Pay arrangement in order for HMRC to agree with you. This evidence might include:

- Sales and cash flow forecasts for the following six months or more

- A plan of how you will cut costs to free up extra cash

- Generally conveying your determination to ensure repayments are met

By providing this documentation, you can demonstrate your need for time to pay and show HMRC that you are willing and able to pay off the debt as quickly as possible, increasing the likelihood of an agreed arrangement. However, make sure that you only offer what your company can realistically afford and meet the obligations outlined in the plan before presenting it to HMRC.

Benefits of using Time to Pay for VAT

- Enhancing cashflow with Time to Pay

The Time to Pay arrangement can enhance cashflow by providing businesses with the flexibility to spread their VAT liabilities over an extended period rather than making a lump sum payment each quarter. By easing the immediate financial burden, businesses can maintain a healthier cashflow, better manage their operational expenses, and avoid potential disruptions caused by a sudden cash outflow.

- Avoiding penalties and interest

If HMRC agrees to a Time to Pay arrangement with you before the payment is due, it can mean reduced or no late payment penalties. The payment plan can cover all outstanding amounts due, including penalties and interest.

Managing your VAT payments under Time to Pay

- Keeping track of payment deadlines

It is imperative to adhere to the deadlines of your Time to Pay arrangement with HMRC to avoid penalties. Timely payment of instalments ensures no further action is taken and keeps HMRC open to future time to pay requests. Non-compliance with the conditions of your Time to Pay arrangement may result in cancellation, with HMRC applying both initial and subsequent late payment penalties as if the arrangement had not been established.

- Communicating with HMRC

If your financial situation improves, you should contact HMRC to discuss increasing your monthly payments. If your circumstances worsen, it is important to discuss reducing your payments with HMRC as soon as possible. Missing payments or cancelling your Direct Debit will prompt HMRC to contact you to resolve the issue, potentially restoring or renegotiating the arrangement. If you fail to communicate or renegotiate, HMRC may resort to tax debt enforcement measures as a last resort.

Additionally, you must immediately report any new debts to HMRC by contacting them to explore payment options. This may involve adjusting your existing Time to Pay arrangements after HMRC evaluates your income, expenditures, and assets.

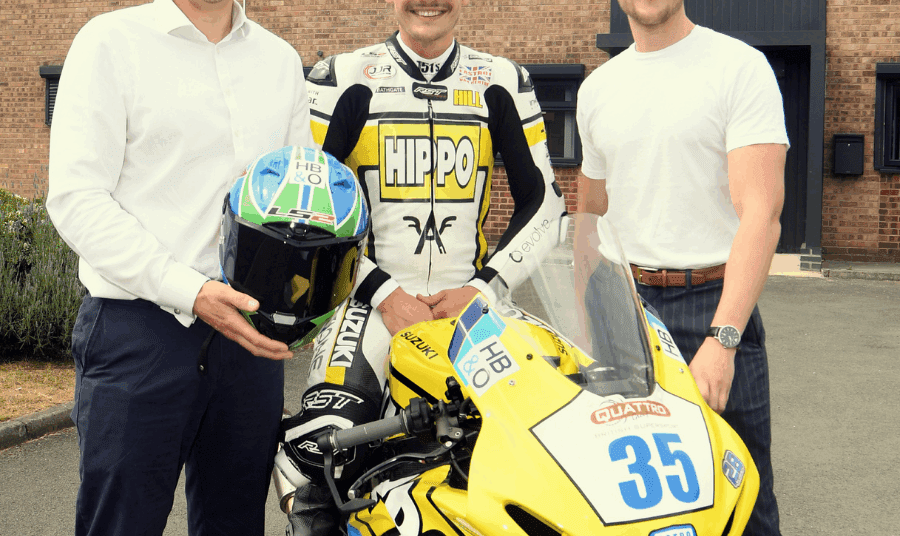

How HB&O can help you

If you would like further support with the online service or are concerned that it will not benefit your business, please get in touch with our in-house VAT department, who will be able to discuss this with you. They can also consider the other options that may be available to help you get through a difficult period and can look into longer-term solutions to aid your business’s VAT cashflow.

Email: [email protected]

Phone: 01926 422292