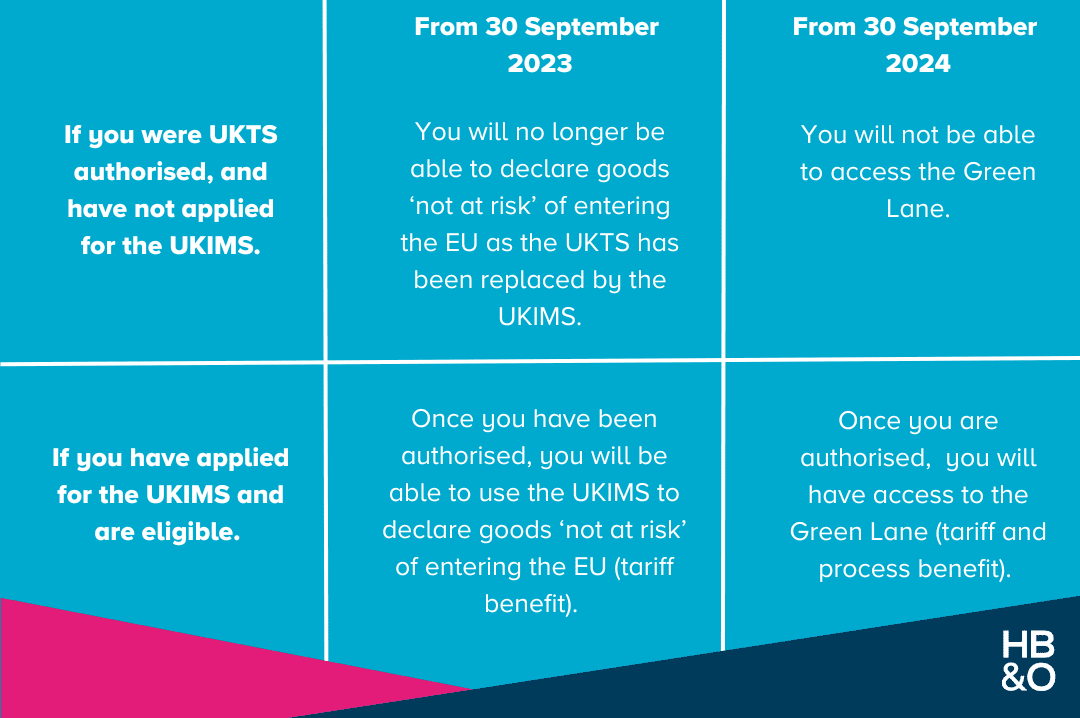

Following the implementation of the arrangements outlined in the Windsor Framework, an enhanced UKIMS has been established to replace the existing UK Trader Scheme from 30 September 2023. Goods moving before this date are able to be declared as ‘not at risk’ under the UK Trader Scheme. After 30 September, the UK Trader Scheme will no longer be valid.

What is the UKIMS?

The UKIMS serves as authorisation for businesses to declare their goods ‘not at risk’ when in transportation between Great Britain (GB) and Northern Ireland (NI). As a result, businesses will be exempt from paying EU duty on the movement of goods that are to remain within the UK customs boundary, including NI. It also means that from September 2024, registered traders will have access to the ‘Green Lane’ where full customs checks and declarations are no longer required.

What happens if you are already authorised under the UK Trader Scheme?

From 30 September, the new UKIMS will come into effect and will enable registered traders to continue to move goods ‘not at risk,’ and from September 2024, will provide access to the ‘Green Lane’ where goods are freed of unnecessary checks and duties. Due to the expansion of the scheme, HMRC requires members of the UKTS to provide additional information to put forward their application for the new system and HMRC may have contacted you already to provide further information as required.

The advisory deadline to register under the UKIMS was 31 July 2023. Although the deadline has passed, HMRC will still process applications and traders are urged to complete registration as soon as possible.

How can you register for the UKIMS?

To apply for the UKIMS authorisation, traders must be established in the UK. The following list sets out some of the other key criteria:

Compliance requirements must be met:

- Businesses must be tax compliant and be able to show a record of this.

- Must have no criminal offenses relating to financial activity.

- Must maintain a good financial standing.

- Show a competent understanding of their obligations under the authorisation and how to adhere to them.

Meet the records, systems, control, and evidence criteria:

- Business owners must be able to describe documented procedures that they use to determine whether goods are ‘not at risk’.

- They will need to be able to show what software or systems are used to track goods from import to consumption.

- Prove that they carry out internal controls that ensure goods are correctly declared ‘not at risk’.

- Finally, businesses will need to provide commercial transport records, such as delivery documentation.

Click here to apply online for authorisation for the UKIMS if you bring goods into NI.

Do you need to register for the new scheme?

If you would like to find out more about the additional eligibility criteria and available guidance during the enrolment process, talk to our in-house VAT department who will be happy to assist.

Email: [email protected]

Phone: 01926 422292 or 02476 306029