How Our Virtual Finance Office Can Transform Your Finance Function

For many growing businesses, managing finances becomes increasingly challenging as things scale. Processes that once worked well start to create friction, and leadership teams lack the information they need to make confident decisions. HB&O’s Virtual Finance Office (VFO) is designed to solve these challenges by providing a fully outsourced, customisable finance function that integrates seamlessly […]

New Business Guide: Essential Checklist for Limited Company Owners

Setting up a limited company is a big milestone, but it also comes with responsibilities. This guide gives you a clear, practical overview of the key things you need to know to help you stay compliant, manage your finances and grow with confidence. Company Setup: Directors and Share Structure Legally, a company is only required […]

HB&O encourages action on Making Tax Digital for Income Tax

A leading Midlands accountancy firm is urging small business owners not to get caught out by a major tax legislation change coming into force in April. HB&O, which has offices in Coventry, Leamington and Birmingham, is warning that many owner-managed business might not be aware of the change or could miss the deadline as they […]

HB&O supports Motormax investment deal

A fleet safety company in Lichfield is on the road to further growth after securing private equity investment in its 15th anniversary year. Motormax, a family-run business based at Shenstone Business Park, has entered into a strategic investment partnership with MxP Partners LLP (“MxP”), which is renowned for scaling high-growth businesses. Initially formed by brothers […]

HB&O delivers reverse advent calendar to support LWS Night Shelter

A leading independent accountancy firm spreads festive cheer to those in need after presenting a special self-curated reverse advent calendar to a local homeless charity. Every day through December, members of the team at HB&O, which has offices in Birmingham, Coventry and Leamington, have been donating essential items to the over-sized advent calendar. The gift […]

HB&O climbs higher in UK’s top 100 accountancy rankings!

A Midlands accountancy firm has topped off a year of sustained growth and significant investment by climbing a prestigious set of industry rankings. HB&O, which expanded its footprint earlier this year by opening an office in Birmingham, has climbed six places in the Accountancy Age Top 50+50 rankings for 2025. The expansion into Birmingham, launch […]

Another round of promotions at HB&O as the year comes to a close

An independent Midlands accountancy firm has made a senior appointment in its Coventry team as part of a series of promotions. HB&O, which has offices in Birmingham, Coventry and Leamington, has promoted Mathew Neal to Head of Accounts Coventry as part of 12 promotions made at the firm. Mathew, from Coventry, joined the business in […]

Budget announcement: our first thoughts

The 2025 UK Budget, delivered by Chancellor Rachel Reeves on 26 November, combined fiscal consolidation with targeted support for households and business. For our clients, the Budget brings urgent focus to pension strategies, property taxation, dividend/savings planning, and cash flow impact for both individuals and businesses. Key announcements Freeze in personal tax thresholds will […]

Autumn Budget 2025 – The Complete Summary

The 2025 Autumn Budget, delivered by Chancellor Rachel Reeves on 26 November, sets out significant changes that will impact both individuals and businesses. From extending tax threshold freezes to capping employee pension contributions caps as well as taxing savings and investments, the measures announced will make staying compliant more complex and bring more people within the scope of tax. In this document […]

Autumn Budget 2025 – The Key Takeaways

Overview Many possible changes were the subject of speculation leading up to the Budget: this list includes things that have been ruled out, as well as changes that the Chancellor announced These key points include measures that were announced previously but are about to come into force Measures which will not take effect until future […]

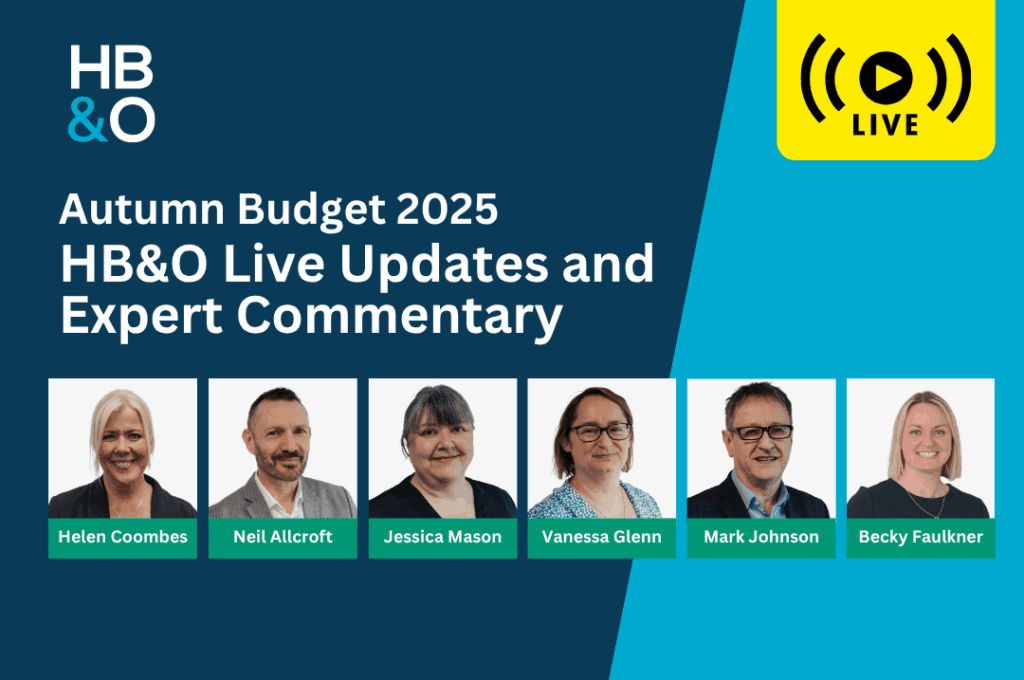

Autumn Budget 2025: HB&O Live Updates and Expert Commentary

Follow our live updates as the Chancellor delivers the Autumn Budget 2025. HB&O’s specialists will share their initial reactions to the key announcements and outline the potential implications for businesses and individuals. Helen Coombes Head of Tax Neil Allcroft Tax Director Jessica Mason Head of VAT Vanessa Glenn Senior Tax Manager Mark Johnson Corporate Tax […]

The limits of AI and why a human touch still matters in tax

Artificial intelligence is improving efficiency in accountancy but continues to struggle with complex tax matters and financial advice, according to an adviser at a leading independent firm. Holly Walker, Tax Senior at HB&O, has highlighted how AI can be a powerful tool to streamline processes, but it is still not ready to advise on complex […]