Budget announcement: our first thoughts

The 2025 UK Budget, delivered by Chancellor Rachel Reeves on 26 November, combined fiscal consolidation with targeted support for households and business. For our clients, the Budget brings urgent focus to pension strategies, property taxation, dividend/savings planning, and cash flow impact for both individuals and businesses. Key announcements Freeze in personal tax thresholds will […]

Autumn Budget 2025 – The Complete Summary

The 2025 Autumn Budget, delivered by Chancellor Rachel Reeves on 26 November, sets out significant changes that will impact both individuals and businesses. From extending tax threshold freezes to capping employee pension contributions caps as well as taxing savings and investments, the measures announced will make staying compliant more complex and bring more people within the scope of tax. In this document […]

Autumn Budget 2025 – The Key Takeaways

Overview Many possible changes were the subject of speculation leading up to the Budget: this list includes things that have been ruled out, as well as changes that the Chancellor announced These key points include measures that were announced previously but are about to come into force Measures which will not take effect until future […]

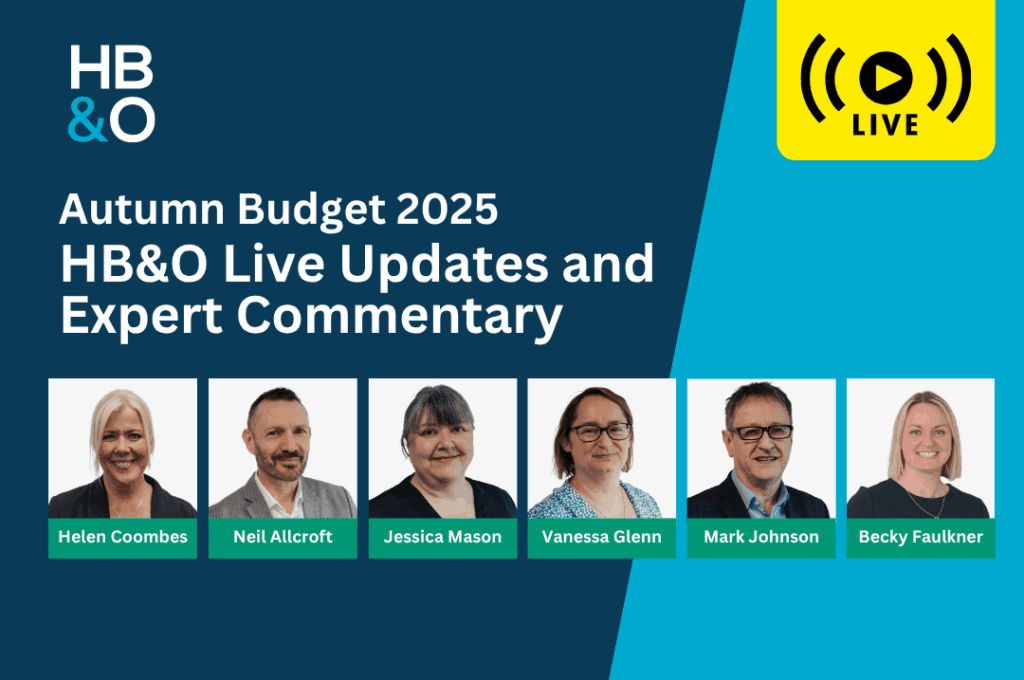

Autumn Budget 2025: HB&O Live Updates and Expert Commentary

Follow our live updates as the Chancellor delivers the Autumn Budget 2025. HB&O’s specialists will share their initial reactions to the key announcements and outline the potential implications for businesses and individuals. Helen Coombes Head of Tax Neil Allcroft Tax Director Jessica Mason Head of VAT Vanessa Glenn Senior Tax Manager Mark Johnson Corporate Tax […]

Autumn Budget 2025: What could be on the horizon?

With the Autumn Budget set for 26 November, attention is turning to how Chancellor Rachel Reeves will balance the need for fiscal discipline with the government’s growth ambitions. The UK faces a widening fiscal gap, and expectations are building that this Budget could mark a turning point in tax policy. While the final measures remain […]

Spring Statement 2025

In her first Budget in October 2024, Rachel Reeves promised that there would only be one ‘fiscal event’ each year – she would not make significant tax changes more frequently. As she repeatedly said during her Spring Statement, the world changes rapidly: economic and political events can disrupt the forecasts that measure her compliance with […]

Autumn Budget 2024 – The Complete Summary

The Autumn Budget, presented by Labour’s first female Chancellor, Rachel Reeves, aims to build a better Britain while supporting growth and the NHS. Although some initial fears regarding tax changes were alleviated, new tax increases, including a rise in Employers’ National Insurance Contributions, sparked debate about their impact on working people. In this document, we […]

Autumn Budget 2024 – The Key Takeaways

Overview Many possible changes were the subject of speculation leading up to the Budget: this list includes things that have been ruled out, as well as changes that the Chancellor announced These key points include measures that were announced previously but are about to come into force Measures which will not take effect until future […]

Budget Announcement: Our First Reactions

Chancellor Rachel Reeves delivered Labour’s first Budget in more than 14 years today (30 October 2024) and pledged to “restore economic stability”, boost long term growth and mark an end to short term planning. Reeves has announced a programme of measures which will see taxes raised by £40 billion. If you have any questions, get […]

Spring Budget 2024

Despite there being few major surprises in the Spring Budget 2024, there is, as always, a great deal of information in the documents that are released on the internet following the Chancellor’s announcement. It is also possible to miss the impact of changes that were announced in previous statements and which are only now coming […]

Autumn 2021 Budget Report

On 27th October 2021, the Chancellor presented the Autumn 2021 Budget Report. In his speech he set out the plans to “build back better” with ambitions to level up and reduce regional inequality. We’ve summarised the key announcements below. Tax measures include: a new temporary business rates relief in England for eligible retail, hospitality […]

A breakdown of the 2021 Budget

On 3 March, Rishi Sunak delivered his second Budget as Chancellor with a three step plan to save, fix and rebuild the economy during and after the COVID pandemic. Unsurprisingly, Sunak started the Budget with updates to the ongoing Covid support measures, extending the furlough and SEISS schemes and announcing additional support to help businesses reopen as the economy starts to reopen. Other announcements […]