HMRC updates policy on VAT recovery for pension scheme costs

HMRC has recently updated its guidance on the recovery of VAT incurred on services related to occupational pension schemes. This adjustment is significant for employers who sponsor pension arrangements for their staff, as it widens the scope of VAT that businesses may be able to recover. What was the previous treatment? Historically, HRMC drew […]

Has HMRC reclassified your care home VAT strategy as tax avoidance?

A longstanding VAT strategy used within the care home sector, where a CQC-registered entity and a non-CQC-registered entity operate under a VAT group, has recently been reclassified by HMRC as tax avoidance. This change, announced in HMRC’s February 2025 Business Brief, marks a significant shift in the regulatory landscape and could have serious financial implications […]

VAT challenges for serviced accommodation providers: should you take action following Sonder’s case?

VAT treatment in the serviced accommodation sector remains a complex issue. Recent Tribunal hearings involving Sonder Europe Ltd have highlighted the challenges businesses in this sector face when it comes to VAT classification and structuring their business in a way that ensures competitiveness in an increasingly saturated market. On the downside, misclassification of the services […]

The future of VAT for online events: what every UK business should know

As of 1 January 2025, the European Union (EU) has implemented significant changes to VAT regulations, directly impacting businesses involved in live streaming and virtual events. These new rules shift VAT liability from the service provider’s location to the consumer’s location. Understanding and adapting to these changes is crucial for compliance and continued success in […]

Update on VAT and Private Schools

Effective from 1 January 2025, all education services, vocational training, and boarding services provided by private schools or connected entities became subject to VAT at the standard rate of 20%. Classes for children of nursery school age will continue to remain exempt from VAT. This means that private schools that were not VAT-registered will have […]

Navigate VAT Registration easily with HMRC’s new Estimator tool

There are signs you can look for to help spot possible bogus communication from HMRC

Managing VAT payments with ‘Time to Pay’ arrangements

The introduction of the new penalty regime for VAT in 2023 made it clear that HMRC believes that all VAT registered persons have a responsibility to account for and pay over the VAT that they have collected from their customers during the course of carrying out trading activities, in a timely manner. For most VAT […]

VAT – a timely reminder to obtain evidence of export

The export or removal of goods from the UK can be treated as a zero-rated supply for VAT purposes but only when the relevant evidence of export has been obtained in accordance with the guidelines set out by HMRC, which may differ depending on the export type. The evidential requirements are set out in […]

A change to the way HMRC manages the clearance of central assessments

HMRC have introduced a significant change to the way in which it manages the clearance of centrally issued assessments and it can catch a taxpayer out. When taxpayers miss the deadline for filing a VAT return, a ‘central assessment’ is raised automatically by HMRC’s system. This is also known as a ‘VAT notice of assessment […]

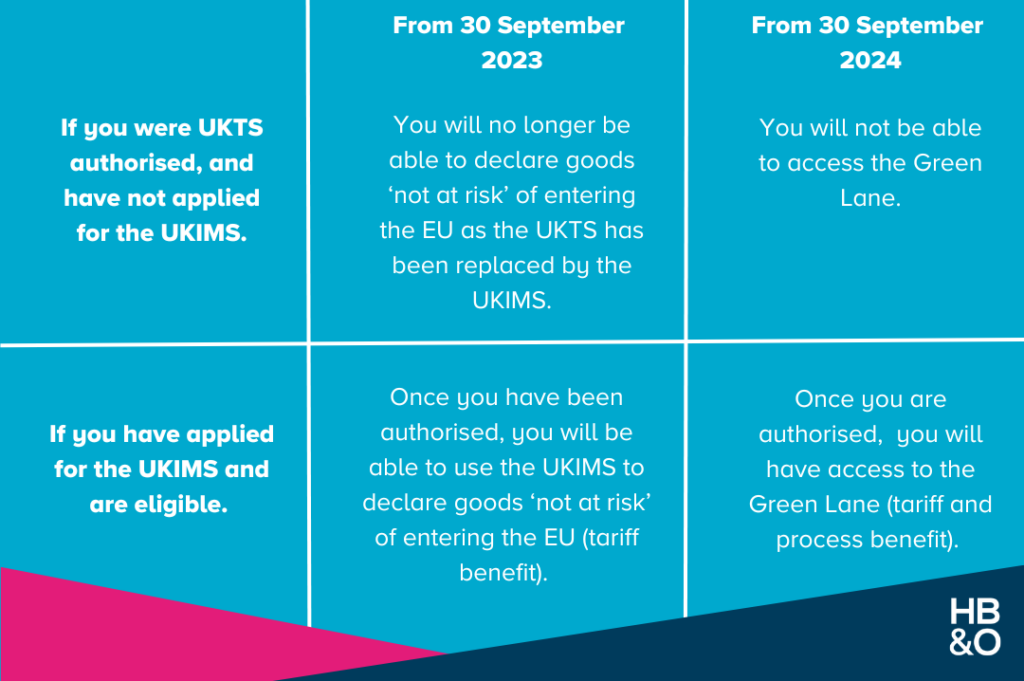

What is the UK Internal Market Scheme (UKIMS) and how do you register?

Following the implementation of the arrangements outlined in the Windsor Framework, an enhanced UKIMS has been established to replace the existing UK Trader Scheme from 30 September 2023. Goods moving before this date are able to be declared as ‘not at risk’ under the UK Trader Scheme. After 30 September, the UK Trader Scheme will […]

What is the Windsor Framework and what does it mean?

How will the Windsor Framework affect the movement of goods between Great Britain (GB) and Northern Ireland (NI)? The Windsor Framework is the culmination of ongoing negotiations which were concluded on 27 February 2023. The new Framework, which makes changes to the Northern Ireland Protocol, has been designed to enable better trading arrangements and movement […]

When should I register my company for VAT?

Sorting out your tax registrations is one of the first things to tick off your to-do list as a new business owner. But knowing when to register for things like value-added tax (VAT) can be a confusing process for new entrepreneurs.Here’s a straightforward summary of what you need to be aware of when looking at […]